Your Essential Guide to Mastering Personal Finance

Building the Foundation of Financial Knowledge

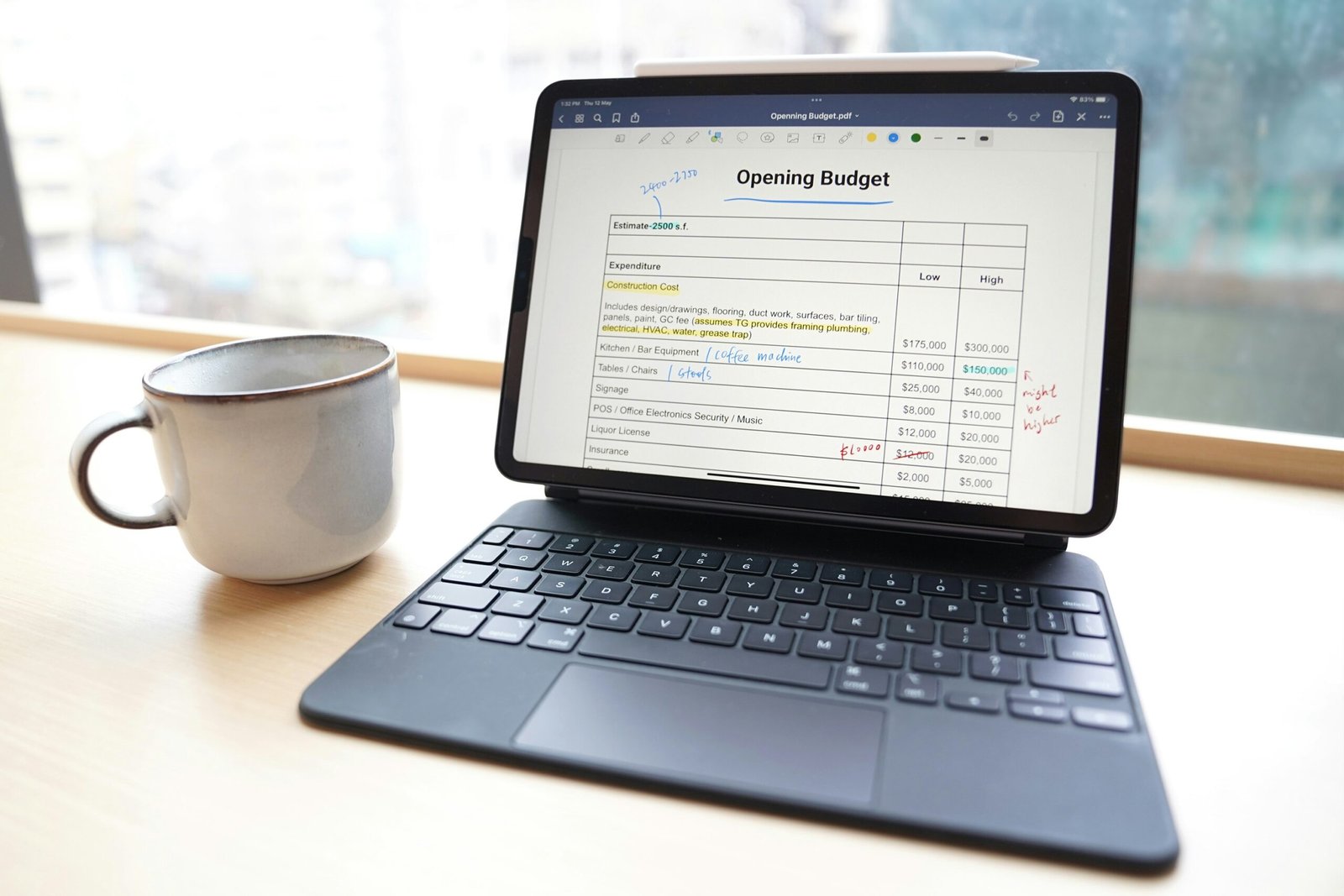

Financial literacy is an essential skill that enables individuals to make informed decisions about their personal finances. The cornerstone of financial literacy begins with understanding key concepts such as budgeting, saving, and the significance of an emergency fund. Budgeting is pivotal as it serves as a blueprint for managing income and expenses. To create an effective budget, individuals should list their income sources, fixed and variable expenses, and review their spending habits. A simple yet effective method is utilizing the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment.

The psychology behind spending plays a crucial role in developing a sound financial mindset. Individuals often engage in impulse buys, driven by emotions or external influences. Understanding these triggers is vital for cultivating healthier spending habits. For instance, before making a purchase, consider waiting 24 hours to assess whether the desire for the item remains. This practice can significantly reduce unnecessary expenses.

Saving money effectively is another essential component of financial knowledge. Establishing an emergency fund should be a priority, as it provides a financial cushion for unforeseen circumstances, such as medical emergencies or job loss. Ideally, this fund should cover three to six months of living expenses. Strategies for saving can include setting up automatic transfers to savings accounts or utilizing apps that round up purchases and save the spare change.

While navigating the path of personal finance, individuals often encounter common pitfalls such as accruing debt or failing to save for emergencies. By setting clear financial goals and regularly tracking progress, one can avoid these pitfalls. Documenting milestones and celebrating achievements can enhance motivation and commitment to financial stability, ultimately leading to a more secure financial future.

Empowering Financial Decision-Making and Strategy

To effectively navigate the complexities of personal finance, individuals must equip themselves with advanced knowledge and strategies that foster informed decision-making. Understanding the fundamentals of investing is essential for building wealth over time. Investment vehicles vary widely, ranging from stocks and bonds to mutual funds and real estate. When selecting an investment option, one should consider individual risk tolerance, time horizon, and financial goals. Adopting a diversified portfolio helps mitigate risk while maximizing potential returns.

Equally important in personal finance is an understanding of credit and debt management. Credit scores are a critical component that impacts not only the ability to secure loans but also the interest rates one may be charged. It is advisable to regularly monitor your credit report for discrepancies and to maintain a low credit utilization ratio. Responsible use of credit cards and timely payments can significantly enhance one’s credit score over time.

Debt repayment strategies also play a vital role in personal financial management. Prioritizing high-interest debts first, often referred to as the avalanche method, can lead to significant savings on interest payments. Conversely, the snowball method advocates for paying off smaller debts first to build momentum. Understanding the implications of student loans, mortgages, and credit card debt is necessary for establishing a solid financial foundation.

Utilizing financial tools and resources can further empower individuals in their journey towards financial mastery. Budgeting apps, investment platforms, and financial planning services offer invaluable guidance. By leveraging educational resources and financial simulators, individuals can devise personalized strategies that align with their financial aspirations, ensuring they make informed decisions conducive to long-term wealth accumulation.

Post Comment