Unlocking Financial Success: Your Go-To Resource for Personal Finance Mastery

Navigating the Basics: Essential Financial Skills for Everyone

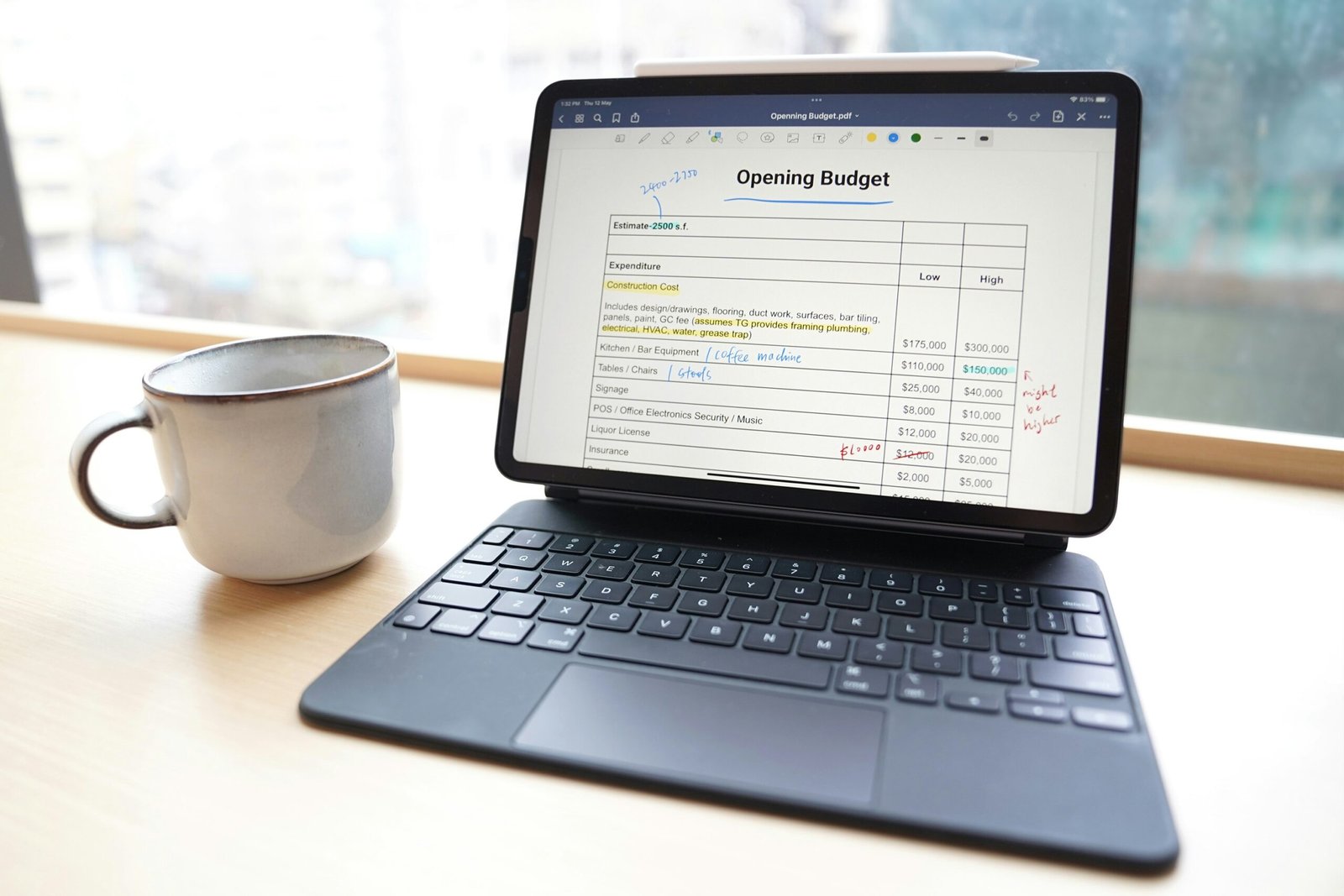

Developing a solid understanding of personal finance is paramount for achieving long-term financial stability. At the core of personal finance management is the practice of budgeting, a powerful tool that enables individuals to allocate their resources effectively. A budget serves as a blueprint for managing income and expenses, helping individuals to prioritize their spending based on their needs and financial goals. Various budgeting techniques exist, such as the 50/30/20 rule, which suggests that 50% of income should go toward necessities, 30% toward discretionary spending, and 20% toward savings and debt repayment. By customizing such methods to fit individual circumstances, anyone can gain better control over their financial situation.

In addition to budgeting, developing effective saving strategies is crucial. A robust savings plan typically begins with setting clear goals, whether they are short-term objectives like building an emergency fund or long-term aspirations such as saving for retirement. One effective approach to saving is automating transfers to savings accounts each month, which ensures that saving becomes a discipline rather than an afterthought. Utilizing high-interest savings accounts or considering alternative savings vehicles, such as certificates of deposit (CDs) or money market accounts, can further enhance the growth of savings over time.

Moreover, tracking expenses is an essential practice that allows individuals to understand their spending patterns better. By keeping a detailed record of all expenditures, individuals can identify areas where they may overspend or discover opportunities to cut back. Specialized apps and tools are available that simplify this process, enabling users to gain insights and make adjustments accordingly. In this way, individuals can develop a deeper sense of financial awareness and empower themselves to make informed decisions about their money. This foundational knowledge sets the stage for further financial mastery and long-term success.

Advanced Strategies: Elevate Your Financial Journey

As you progress along your personal finance journey, understanding advanced strategies becomes crucial for optimizing your financial outcomes. One key area of focus is investing, where familiarity with various options can significantly enhance your portfolio’s potential. Among the fundamental investment vehicles are stocks, bonds, and mutual funds, each carrying distinct risk profiles and return potentials. Stocks, for instance, can yield high returns but come with increased volatility, while bonds typically offer lower returns but present a more stable investment environment. Mutual funds, on the other hand, blend multiple assets, allowing for diversification while potentially mitigating risk.

It’s imperative to assess your risk tolerance and investment objectives before choosing the right investment vehicle. Tools such as risk assessment questionnaires can help identify your comfort level with market fluctuations, thereby guiding you toward suitable investment choices. Additionally, various online platforms and robo-advisors provide personalized investment strategies based on your financial goals, making it easier than ever to enter the world of investing.

Another critical aspect of personal finance mastery involves effective debt management. Many individuals face challenges with outstanding liabilities, but employing sophisticated debt repayment strategies can create pathways toward financial freedom. One well-regarded approach is the snowball method, where smaller debts are prioritized, allowing for quick wins that can demystify the debt repayment process. Alternatively, the avalanche method focuses on paying off high-interest debts first, potentially saving you money in the long run.

Real-life case studies illustrate how individuals have successfully navigated both investment and debt management challenges. For example, by diligently following a structured repayment plan while simultaneously investing consistently, many have achieved improved financial stability and independence. Utilizing available resources, knowledge, and strategies empowers individuals to navigate their financial journeys with confidence and resilience.

Post Comment